Cahill represented the underwriters in the transaction.Charter Communications Operating, LLC and Charter Communications Operating Capital Corp., wholly owned subsidiaries of Charter Communications, Inc. executed a public offering…

- Homepage

- North America

- North America Legal Chronicle

- Charter Communications’ $4 Billion Secured Notes Offering

Charter Communications’ $4 Billion Secured Notes Offering

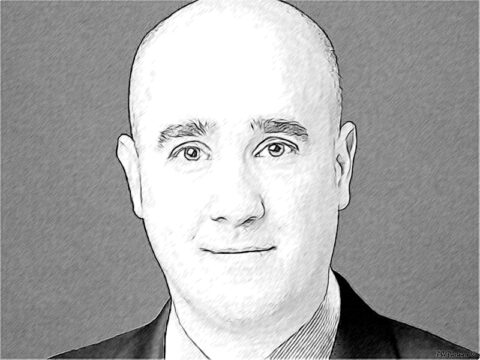

Tagged: Academy Securities Angelica Body-Lawson Bank of America Securities Barclays Capital BNP Paribas Securities Cahill Gordon & Reindel Citigroup Global Markets Ltd Corey Wright Credit Agricole Securities (USA) Inc. Credit Suisse Securities (USA) LLC Deutsche Bank Securities Goldman Sachs & Co. J.P. Morgan Securities LLC LionTree Advisors LLC Loop Capital Markets Maria Vlasie megadeals MFR Securities, Inc. Mizuho Securities Morgan Stanley MUFG Securities Americas Inc. Paula Azulay RBC Capital Markets Samuel A. Ramirez & Company, Inc. Scotia Capital Inc. SMBC Nikko Securities America Stephen Gruendel TD Securities Timothy Cusack Timothy Howell Truist Securities Inc. U.S. Bancorp Investments Wells Fargo Securities